Setting up your business is not a stable task in the initial phase because there are a number of things that are needed to be done appropriately. It can be as unchallenging as selecting the color of the paint to be used in your office or as complex as properly executing all the professional and legal documentation to set up your business. Be that as it may, it takes real efforts, patience, craftsmanship and hard work to create a strong business. One of the biggest hurdles which come while establishing a business in some cases is the accumulation of stable sources of capital to be used. Many times several start-ups face this problem of absence of required amount of capital which could have been beneficial for their company. Even huge organizations do require financial assistance every now and then. Nowadays there are many financing organizations which are willing to provide required loans to any start-up, or a well established company, who is in the dire need of financial aid. In order to acquire one for yourself, you need to put up a well drafted Business Finance Loan Agreement.

In case you are not well versed with the concept of a Business Finance Loan Agreement, it precisely elucidated below for your better understanding. So without any further ado, let’s learn.

In order to acquire capital for your business, you must first thoroughly research, which financing organization can meet your expectations of providing stable assistance. There are many factors to be looked upon, the duration of procedure the time taken for the amount to reflect in your bank, interest rates etc.

A business loan agreement is a legally binding contract between you and your lender. It specifies each party's obligations and formalizes the borrowing procedure. Since business loan agreements also include conditions and clauses, it's important to read the agreement, read the fine print, and ask questions before signing so you can inform yourself and fully understand what you're agreeing to.

A business loan agreement does not only protect the borrower but also the lender in the same place. Having a legal document those details the terms and conditions of your loan will help you avoid misunderstandings and hindrances, at the same time it directs you through the repayment process.

A business loan agreement is necessary for various other reasons which are enumerated below:-

If you took out a loan from a conventional lender, you'll be given a typical loan agreement that outlines on how and when you will have to repay the principal loan sum as well as any interest that has accrued on the amount taken by you as a loan. Traditional lenders, such as banks, have stricter requirements, and the interest rate is determined by factors such as your credit history, FICO (Fair Isaac Corporation) ranking, and whether or not you have an underwriter. If you're giving up some of your company's equity, you'll want to include it in the contract as well.

Even if you're borrowing from a family member or a friend, getting a written agreement in place that spells out how and when you'll pay back the loan is crucial, and it can even prevent a partnership from falling apart due to financial issues. Having a sound business loan agreement in place never hurts and avoids any future misunderstandings one might face in the absence of it.

PP and E is commonly denoted as property, plant and equipments. These are the 3 basic things every one requires in order to establish a new company. PP&E refers to non-liquid assets such as real estate, operating facilities, vehicles, and inventory. If you have a PP&E loan, your lender can seize your assets if you default or otherwise fail to meet the loan conditions. When it comes to PP&E loans, it's particularly important to understand the terms of the loan and be aware of the penalties for late payments and defaults.

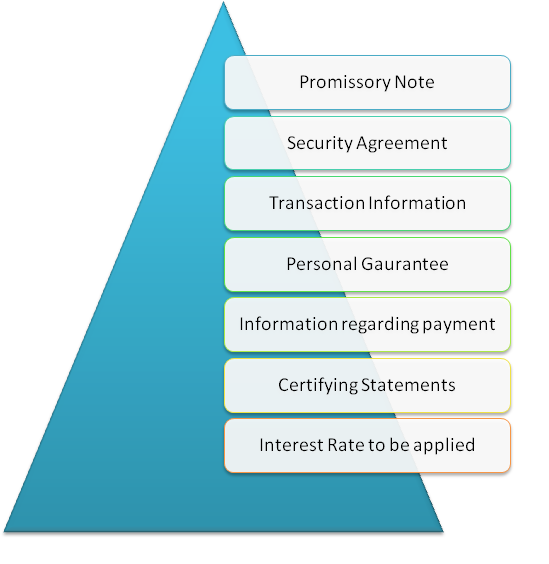

Understanding the basic building blocks of a business loan agreement is critical, whether you're evaluating one from a bank or financial institution or drafting one yourself to handle a loan from a friend or family member. Almost all loan agreements include the following elements:

The abovementioned chart is elucidated below for a better understanding:-

A promissory note is a written obligation by one party (borrower) to another party (lender) to pay a specified amount to the lender by a specified date. The promissory note also includes the loan's terms, such as the principal sum, interest rate, and maturity date. The date, time, and position of the signing are all listed on the note. The promissory note is legally binding and imposes a legal duty to repay the loan.

The security agreement is a legal contract that grants the lender a security interest in an asset or property that you (the borrower) own and intend to use as collateral to protect your loan. If you default on the loan, the lender has the right to take the collateral and use it to pay off the debt. A loan cannot be secured unless you sign a protection agreement; however, not all lenders demand that your loan be secured, so make sure to inquire about this with your lender.

This section specifies the exact sum you owe your lender once the agreement is in place, your principal, interest is not included in this figure. This segment also explains what you'll get in exchange for the money you pledge to pay the lender.

A personal guarantee is an arrangement that allows a lender to use your personal assets (which may include your vehicle, home, savings, or retirement fund, depending on their value) to repay a loan if your company is unable to repay it. Personal guarantees lower the lender's risk by granting the lender the legal right to seize your personal assets if you default. You consent to be entirely responsible for the repayment of the principal sum as well as all other costs associated with the loan, such as interest, when you sign a personal guarantee. Many lenders that provide loans to small businesses follow this procedure.

This section explains how you'll pay back the loan, how often you'll make payments, and which payment methods (cash, credit card, debit payments, wire transfer) are accepted. This segment also outlines the consequences of prepayment or late payment. You may be able to prepay a portion or your entire loan, but you will almost always be charged a fee if you pay off your debt before the deadline. If you can't afford your loan payments, this section explains the consequences, such as if the penalty is a flat fee, a percentage of the missed payment, or assets (personal or business) that the lender will take as a means of repayment if you default on your loan.

Finally, as the creditor, you must attest to the accuracy of all claims. This typically requires statements that you are lawfully permitted to do business, that you are not involved in any litigation that might jeopardize your ability to repay your loan, that your company has filed and paid all taxes, and that your financial statements are true and correct.

This is the expense of borrowing the principal as a percentage. Easy or compounding interest rates are available. Simple interest rates are based on the loan's principal sum, while compound interest rates are calculated on both the principal and previously accrued interest. This section also explains whether the interest rates are variable or fixed; variable rates adjust over time, while fixed rates remain constant over the term of the loan. The type of loan you have, your credit score, and whether or not the loan is secured or unsecured all influence your interest rate.

In the end we can conclude with the fact that a sound Business Finance Loan Agreement is a must to get the financial assistance you are in need of to start your business or create a stability in your pre-established business as a whole. Therefore a precisely drafted and well understood Business Finance Loan Agreement is sin qua non for both the lender and the borrower.